An accident, burn-out or chronic back problems, no one is immune from health problems. From a statistical point of view, “every fourth employee has to give up their job prematurely for health reasons or retire from working life”, according to the German pension insurance. In addition to health concerns, the question often arises of how to compensate for the loss of wages. From a purely legal point of view, there are major differences between the terms disability and occupational disability, which are particularly important with regard to any state or private benefit entitlements.

definition

Inability to work is precisely defined in Section 43 of the Sixth Social Code (SGB VI): "Fully incapacitated persons are insured who are unable to work for at least three hours a day due to illness or disability for the foreseeable future under the usual conditions of the general labor market."

According to this definition, anyone who can work between three and six hours a day is partially incapacitated. Anyone who is able to work more than six hours a day is not deemed to be incapacitated.

“Unforeseeable time” means a span of more than half a year. Inability to work or reduced earning capacity are not identical with occupational disability. The latter only means that you can no longer work in the last practiced or learned profession for health reasons: If a driving instructor can no longer give driving lessons due to paralysis, he could theoretically work as a coach, for example. As a result, he is not disabled.

When defining reduced earning capacity, the theoretical possibility of doing another job is important. Practical opportunities on the labor market are unimportant. In Section 43 of SGB VI, it says: "... the respective labor market situation is not to be taken into account."

Legal meaning

Incapacitated persons who were born after January 1, 1961 are therefore only entitled to statutory disability pension if, due to their health condition, not a single occupation on the German labor market can be carried out for at least six hours a day for six months. In addition - with a few exceptions - you must have been a member of compulsory insurance in the last five years and have paid contributions for three years.

State pension & basic security

Even in the case of entitlement, the statutory disability pension is not high: The full rate is between 30% and 38% of the last gross income if you are able to work for less than three hours. Half the rate is between 15% and 19% of the last gross salary if you are able to work for less than six hours but more than three hours a day.If necessary, taxes and health insurance contributions are paid.

If you are below the subsistence level, you can apply for basic security in accordance with Chapter 4 of the Twelfth Social Code (SGB XII). The prerequisite is that you and your partner do not have any assets that can be used to make a living. Those entitled to basic income support are assigned to a standard requirement level and receive between € 234 and € 399 per month (as of January 1, 2015), plus expenses for accommodation and heating, possibly additional amounts, as well as exemption from pension and compulsory insurance contributions. Usually this results in a higher three-digit range.

Regular, statutory old-age pension entitlements only exist when a corresponding age has been reached. Here, too, no high payments are to be expected, especially if one has not been employed for a long time. According to the Gesamtverband der Deutschen Versicherungswirtschaft e.V. (GDV), those newly retired in 2014 receive an average of three-digit monthly sums according to the statistics of the German Pension Insurance: For men who retired in 2014 this was € 975 per month, for women € 533. Detailed information on the legal framework with regard to reduced earning capacity is available from the statutory pension insurance, the social welfare offices and of course the social security codes.

Private provision: occupational disability insurance

Inability to work often results in financial hardship, especially if you were self-employed and not compulsorily insured. Therefore, depending on the circumstances, private provision makes sense:

For example, daily sickness allowance agreements are possible as an additional component of private supplementary health insurance - you receive a previously agreed daily rate if the employer or health insurance company no longer pays wages. However, this option cannot be viewed as a permanent solution, but primarily as a bridge until the person can return to work.

Accident insurance is not a substitute for a pension either: a one-off sum is paid out. And only if the disability was caused by the accident. Comprehensive protection, however, is offered by occupational disability insurance, which guarantees monthly payments in an individually agreed amount until retirement age.

In the case of private insurances, however, you should generally check all contract details carefully: In the case of occupational disability insurance, for example, the clauses of "abstract referral" or the "examination of previous professions" should be excluded, because then the insurer cannot refer to other theoretically tangible professions in an emergency. A 6-month forecast should also be agreed so that you have pension entitlements at an early stage and not only after three years have passed.

The online comparison portal tarifcheck24.com offers an overview of a wide variety of insurances, important contract details, as well as free and non-binding comparison options.

Most frequent causes for occupational disability

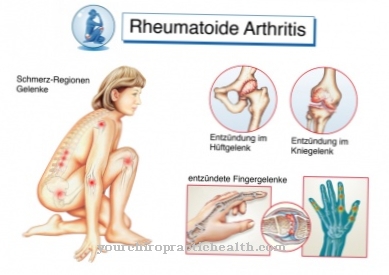

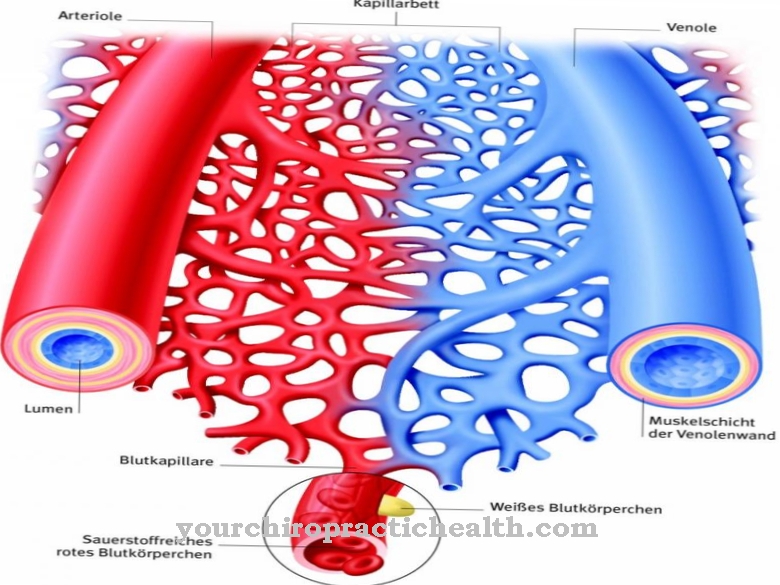

As early as 2013, mental or nervous diseases overtook the former number 1 in occupational disability - according to a Statista study: Over a quarter (28.67%) therefore left working life. 22.65% could no longer work due to diseases of the “skeletal and musculoskeletal system”, 15.07% due to cancer. Accidents were the cause of one tenth (10.14%), and 7.96% of them were "cardiovascular diseases".

Some occupations seem objectively riskier than others; Welders, roofers and lumberjacks, for example, are exposed to great physical stress and operate dangerous equipment. However, this does not take into account typical office illnesses such as burn-out, stress or back problems, which now make up more than half of all causes of occupational disability.

Of course you hope that you stay healthy yourself, but a healthy lifestyle does not always protect against emergencies. It is therefore advisable to find out about pension models in good time. If you opt for private pension provision, the younger and healthier you are when you sign the contract, the cheaper the contributions.

.jpg)

.jpg)

.jpg)